Theories of interest rates

(i) Time Preference Theory: This theory was formulated by Irving fisher who defined interest as an index of the communities' preference for money of present over money of future income.

Time preference is the preference that people have for present income over future income of an equal amount and equal certainty. Interest therefore is the price that is paid to the people for present income rather than future income. It is determined by:

- The rate of marginal time preference or willingness or impatience.

- The rate of marginal return over cost or investment opportunity principle.

Criticism of time preference theory.

- The theory is very general and fails to show the influence of banking system on the rate of interest

- The willingness principle is misleading because it lays to much emphasis on consumption out of income.

- The theory is silent about the impact of expectations on interest rates i.e. even if the interest rates are upward moving, expectations of high future returns can encourage investments.

- It lays too much emphasis on capitalization which is not a good guide on values.

(ii)Classical theory of interest

According to the classical theory, the rate of interest is determined by the supply and demand of capital. The demand for capital consists of demand or productive and consumption purposes while supply of capital depends upon the will to save and the power to save of the community as some people save irrespective of the rate of interest.

The supply of interest is governed by the time preference and the demand for capital by expected productivity of capital. Both time preference and the productivity of capital depends on the waiting or saving. Thus, interest rate is determined by the interaction of the demand and supply curves of capital.

Criticism of the theory

- Income is variable and not constant as assumed and the quantity between savings and investment is brought about by changes in income and not by variables in the rate of interest.

- Saving and investment schedules are not independent of one another as assumed in the theory.

- The theory neglects the effects of investment on income e.g. a rise in the rate of interest leads to decline in the decline investment by making it less profitable which consequently leads to decline to output, employment and income.

- The theory is indeterminate. Since savings depends on the level of income, it is not possible to know the rate of interest unless the income level is known beforehand.

- It ignores other sources of capital other than saving out of the current income in the supply schedule of savings. Other sources of capital include past savings, bank credits etc.

- It is based on unrealistic assumption of full employment where waiting or abstinence is necessary to induce people to save. However, underemployment is the real situation where resources are unemployed and interest is essentially not an inducement to save.

- The theory is based on the factors like time preference -and marginal productivity of capital while ignoring monetary factors in the determination of interest rate. They regarded money as a veil and not a . store of value.

(iii)The loanable fund theory of interest

The neo-classical loanable fund theory explains the determination of interest in times of demand and supply of loanable funds or credits.

According to this theory, the rate of interest is the price of credit which is determined by the demand and supply of loanable fund. It is the price that equates the supply of credit to the demand for credits.

The demand for loanable funds comes from three main sources:

- The government which borrows for constructing public works or for war preparations.

- The businessman who borrow for the purchase of capital goods and for starting investment projects. Such borrowings are interest elastic and demand mostly on the expected rate of profits as compared with the rate of interest.

- Consumers who use the loanable funds for the purchase of durable consumer goods. The tendency to borrow is more at a lower rate than at a higher rate in order to enjoy their consumption soon.

Supply of loanable funds

The supply of loanable funds comes from the following sources:

- Saving of both private individuals and corporate bodies.

- Dishoarding which are directly related to the rate of interest such that at high rates of interest, larger funds comes out of hoarding and vice versa

- Bank credits that are lent out by the financial institutions. This is also interest elastic such that at higher rates of interest, more funds are lent than at lower rates.

(iv). Keynes' liquidity preference theory of interest

Keynes defines the rate of interest as the reward for parting with liquidity for a specified period of time. According to him, the rate of interest is determined by the demand for and supply of money.

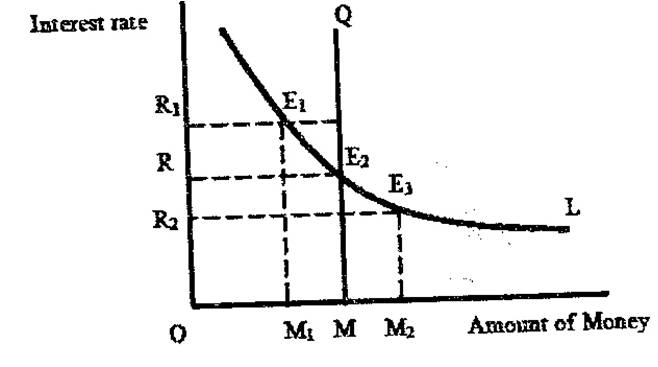

Determination of the Rate of Interest: Like the price of any product, the rate of interest is determined at the level where the demand for money equals the supply of money. In the following figure, the vertical line OM represents the supply of money and L the total demand for money curve. The curves intersect at E2 where the equilibrium rate of interest OR is established.

If there is any deviation from this equilibrium position an adjustment will take place through the rate of interest, and equilibrium E2 will be re-established.

At the point E1 the supply of money OM is greater than the demand for money OM1. Consequently, the rate of interest will start declining from OR1 till the equilibrium rate of interest OR is reached. Similarly at OR2 level of interest rate, the demand for money OM2 is greater than the supply of money OM. As a result, the rate of interest OR2 will start rising till it reaches the equilibrium rate OR.

It may be noted that, if the supply of money is increased by the monetary authorities, but the liquidity preference curve L remains the same, the rate of interest will fall. If the demand for money increases and the liquidity preference curve sifts upward, given the supply of money, the rate of interest will rise.

Criticisms:

Keynes, theory of interest has been criticized on the following grounds:

- The rate of interest is not purely a monetary phenomenon. Real forces like productivity of capital and thriftiness or saving' by the people also play an important role in the determination of the rate of interest.

- Liquidity preference is not the only factor governing the rate of interest. There are several other factors which influence the rate of interest by affecting the demand for and supply of investible funds.

- The theory does not explain the existence of different rates of interest prevailing in the market at the same time.

- Keynes ignores saving or waiting as a means or source of investible fund. To part with liquidity without there being any saving is meaningless.

- 'The Keynesian theory only explains interest in the short-run. It gives no clue to the rates of interest in the long run.

- Keynes theory of interest, like the classical and loanable funds theories, is indeterminate. We cannot know how much money will be available for the speculative demand for money unless we know how much the transaction demand for money is.