The structure of a national economy

With all foreign economies, which is the fifth sector known as the Foreign Sector Household. Consists of the entire population of a country as they are arranged in micro units [individuals or families). Households are the suppliers of resources (Labour, Entrepreneurship, money capital, land and innovations) and the consumers of all final goods and services produced in the economy.

Ugandan Women: households are engaged in

certain non-remunerative types of productive activity such as

child-rearing, cooking, cleaning, household maintenance and repairs.

Ugandan Women: households are engaged in

certain non-remunerative types of productive activity such as

child-rearing, cooking, cleaning, household maintenance and repairs.

In addition to being suppliers of resources and consumers of goods and services, households are engaged in certain non-remunerative types of productive activity such as child-rearing, cooking, cleaning, household maintenance and repairs. Households derive their monetary income by supplying resources to firms, while they spend the bulk of their after-tax income on procuring consumer goods and services.

Firms (producers). Firms are organisational units set up and managed by households whose sole objective is to acquire and transform raw resources into useful goods and services which are then sold to consumers or other firms for a profit. Firms are of all types, big corporations as well as small businesses; they may be incorporated or unincorporated, and they are involved in all stages of production, i.e. extraction, manufacturing trade -and services.

Financial sector. The financial sector includes all non-industrial firms whose sole purpose is financial intermediation and financial services (deposits, lending, payment and investment services]. They include banks, trust companies, and investment bankers, dealers and brokers, investment and mutual funds, credit unions, finance companies and life insurance companies. Their role is to channel funds from surplus units to deficit units.

Government. Government has three broad areas of activity:

Care taking. This includes overall administration and co-ordination,

provision of justice, national defence, foreign relations;

Firms (producers). Firms are organisational units set up and managed by households whose sole objective is to acquire and transform raw resources into useful goods and services which are then sold to consumers or other firms for a profit. Firms are of all types, big corporations as well as small businesses; they may be incorporated or unincorporated, and they are involved in all stages of production, i.e. extraction, manufacturing trade -and services.

Financial sector. The financial sector includes all non-industrial firms whose sole purpose is financial intermediation and financial services (deposits, lending, payment and investment services]. They include banks, trust companies, and investment bankers, dealers and brokers, investment and mutual funds, credit unions, finance companies and life insurance companies. Their role is to channel funds from surplus units to deficit units.

Government. Government has three broad areas of activity:

Care taking. This includes overall administration and co-ordination,

provision of justice, national defence, foreign relations;

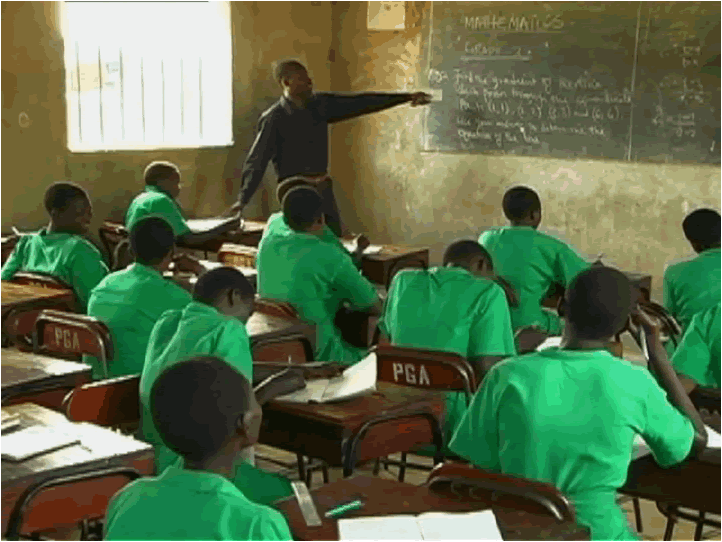

Education provided here is a service

Education provided here is a service

Provision of services.

This includes public health, public education, police and fire

protection, public roads, parks, facilities; transportation and

communication services.

Social protection. This includes old age pensions, unemployment insurance, welfare payments, family allowances.

Government activity is financed through the imposition of various forms of taxes, levies and fees. There are two general types of taxes:

Direct taxes. Individual income Lax, Corporation income tax, Capital gains tax.

Indirect taxes. Value Added Tax (VAT), Goods and Services tax, Excise taxes, Import duties, Property taxes.

Foreign sector. Each nation sells part of its production to foreign nations while it imports part of its domestic consumption from foreign nations. In addition, capital, technology and resources are transferred among nations giving rise to international capital and investment flows. All these interconnections of a nation's economic activity with the " the-world" are grouped under this sector.

Government activity is financed through the imposition of various forms of taxes, levies and fees. There are two general types of taxes:

Direct taxes. Individual income Lax, Corporation income tax, Capital gains tax.

Indirect taxes. Value Added Tax (VAT), Goods and Services tax, Excise taxes, Import duties, Property taxes.

Foreign sector. Each nation sells part of its production to foreign nations while it imports part of its domestic consumption from foreign nations. In addition, capital, technology and resources are transferred among nations giving rise to international capital and investment flows. All these interconnections of a nation's economic activity with the " the-world" are grouped under this sector.

Along with this, there should be improvements of roads and markets,

introduction of new consumption goods and development of banking and credit arrangements. In the rural areas of most LDCs, this process is still not very far advanced. Subsistence production remains the dominant pattern.

introduction of new consumption goods and development of banking and credit arrangements. In the rural areas of most LDCs, this process is still not very far advanced. Subsistence production remains the dominant pattern.