Practical importance of price elasticity of demand

The concept of price elasticity of demand is very important in a number of aspects.

Producer's revenue and price elasticity of demand. The concept of price elasticity of demand helps the producer to fix the price so as to determine the revenue. The decision of the producer whether to increase or decrease price will depend upon the price elasticity of demand for the commodity. Prices are normally fixed at a higher level if the price elasticity of demand for the product is low. On the other hand, if the demand for the product is elastic, the price will be fixed at a lower level since there are many close substitutes, or the commodity is a luxury. An increase in the price of the commodity does not necessarily lead to an increase in producer's revenue. This will depend on the price elasticity of demand for the commodity.

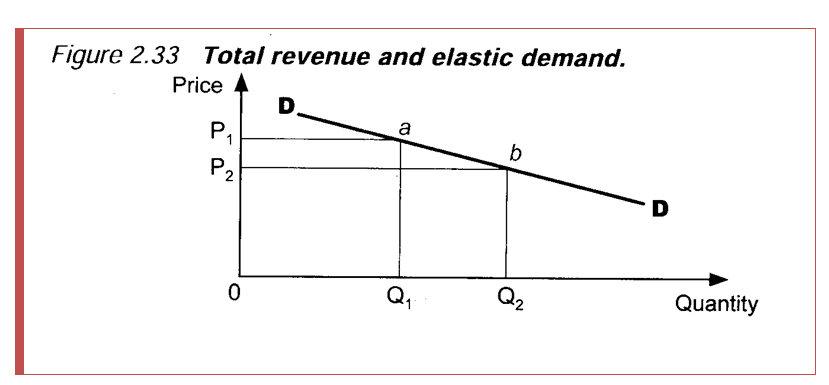

1. Elastic demand. Total revenue will increase if price is reduced in case of elastic demand. Higher revenues are associated with lower prices OP2 (Figure 2.33) (OQ2bP2 )

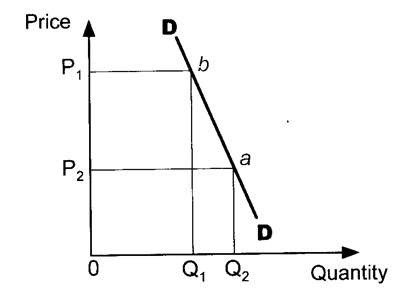

2. Inelastic demand. Total revenue will increase if price is increased in case of inelastic demand. Higher revenues are associated with higher prices OP-, (Figure 2.34) (OC bP OQ2aP2).

Total revenue and Inelastic demand.

3. Unitary elasticity of demand. The producer's revenue will remain the same as price changes. Revenue associated with lower prices is the same as those associated with higher prices (Table 2.7).

Relationship between price elasticity of demand, price changes and revenue (expenditure).

· Elastic demand

· Increase in price Decrease in price

· Fall in revenue Increase in revenue

· Fall in expenditures Increase in expenditure

· Inelastic demand

· Increase in price Decrease in price

· Increase in revenue Fall in revenue

· Increase in expenditure Fall in expenditure

· Unitary elasticity

· Increase in price Decrease in price

· No change in revenue No change in revenue

· Same expenditure Same expenditure

· Elastic demand

· Increase in price Decrease in price

· Fall in revenue Increase in revenue

· Fall in expenditures Increase in expenditure

· Inelastic demand

· Increase in price Decrease in price

· Increase in revenue Fall in revenue

· Increase in expenditure Fall in expenditure

· Unitary elasticity

· Increase in price Decrease in price

· No change in revenue No change in revenue

· Same expenditure Same expenditure

Consumer's expenditure and price elasticity of demand. The consumer's expenditure is equal to the producer's revenue. Consumer's expenditure increases when the price is reduced in case of elastic demand or when the price is increased in case of inelastic demand. Consumer's expenditure remains the same as price changes, if the demand is of unitary elasticity (Table 2.7).

Taxation and price elasticity of demand. Taxes are imposed for various reasons. Two cases can be considered.

Taxation and price elasticity of demand. Taxes are imposed for various reasons. Two cases can be considered.

To raise revenue. If the government wishes to raise revenue, it must tax commodities, which have got inelastic demand.

To discourage the development and consumption of a certain commodity.

To discourage the development and consumption of a certain commodity.

If the government wants to discourage the development and consumption of a certain commodity, it may impose a tax. The extent to which the taxation policy succeeds depends on the price elasticity of demand for the commodity. The government will be successful in discouraging the development and consumption of commodities that have got elastic demand.

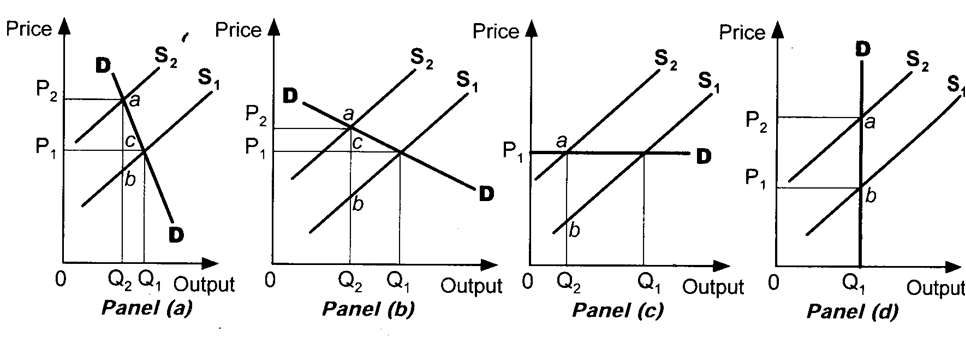

Tax incidence and price elasticity of demand. Price elasticity of demand helps to determine how much the consumer and producer will have to pay of a tax. If the demand for the commodity is inelastic, (Figure 2.35(a)) the consumer pays a larger portion of the tax, whereas if it is elastic, (Figure 2.35(b)) the producer pays a larger portion. With unitary elasticity, the tax is shared equally between the consumer and producer. If the demand is perfectly elastic, the producer pays the tax alone. The consumer pays it alone if the demand is perfectly inelastic (Figure 2.35(d)).

Price elasticity of demand and tax incidence.

Price elasticity of demand and tax incidence.

ab = Tax, ac = Paid by the consumer, cb = Paid by the seller

Consider the case of elastic demand. Before the tax was imposed, the

consumer was paying OP1. After the imposition of the tax, the consumer pays OP2. She pays P-\^2' which is ac of the tax imposed. This represents a smaller portion of the tax. The other bigger portion of the tax, which is cb, is paid by the seller. If the demand for the commodity is elastic, it should be obvious why the seller pays a larger portion of the tax. This is because a commodity with elastic demand must be having a number of substitutes or might be a luxury or expensive. Therefore, it is better for the seller to bear a bigger portion of the tax otherwise she will lose most of the customers if she tries to shift a larger proportion of the tax onto the consumers.

consumer was paying OP1. After the imposition of the tax, the consumer pays OP2. She pays P-\^2' which is ac of the tax imposed. This represents a smaller portion of the tax. The other bigger portion of the tax, which is cb, is paid by the seller. If the demand for the commodity is elastic, it should be obvious why the seller pays a larger portion of the tax. This is because a commodity with elastic demand must be having a number of substitutes or might be a luxury or expensive. Therefore, it is better for the seller to bear a bigger portion of the tax otherwise she will lose most of the customers if she tries to shift a larger proportion of the tax onto the consumers.

Price elasticity of demand and subsidies. Price elasticity of demand can determine who benefits from a subsidy whether the producer or consumer.

Subsidies may be regarded as negative taxes. They normally take the form of payments by governments to producers. The effect of the subsidy is to reduce the costs of production. The supply curve shifts to the right by the amount of subsidy. More is supplied at any given market place.

Consumers benefit through a price fall. They now consume more at a lower price.

If the demand is elastic, the granting of a subsidy would lead to a relatively small reduction in price, but a relatively large increase in the consumption.

The producer would benefit greatly in terms of cost reduction. The opposite effects would apply if the demand were inelastic. The subsidy would benefit the consumers more than the producers. The consumers would experience a relatively larger fall in the price, but a relatively small increase in consumption. The cost of production would fall marginally. For the perfectly elastic demand curve, it is the producer who benefits from the subsidy. The consumer would be paying the same price even after the subsidy. The consumer benefits alone if the demand is perfectly inelastic. The price to the consumer reduces by the amount of the subsidy.

Import tax and price elasticity of demand. An import tax can be imposed for three major reasons.

To raise revenue. Higher revenues will be obtained when the import tax is imposed on commodities, which have got inelastic demand.

To protect home industries. An import tax can be for the protective

purposes. Such a tax should be imposed on commodities that have got elastic demand.

purposes. Such a tax should be imposed on commodities that have got elastic demand.

To reduce the demand for foreign currency. An import tax can be imposed with the aim of reducing foreign exchange expenditure so as to improve the balance of payments position. This will be possible if the tax is imposed on commodities that have got elastic demand.

Devaluation and price elasticity of demand. Devaluation is the legal reduction of the value of a country's currency in terms of other currencies.

The purpose of devaluation is to earn more foreign exchange so as to

improve the balance of payments position. Devaluation will be successful if the price elasticities of demand for both imports and exports are elastic.

improve the balance of payments position. Devaluation will be successful if the price elasticities of demand for both imports and exports are elastic.