Determination of equilibrium price and quantity

So far we have considered demand and supply separately. We now come to a key question: how do the two forces of demand and supply interact to determine price. The equilibrium price is determined within a market.

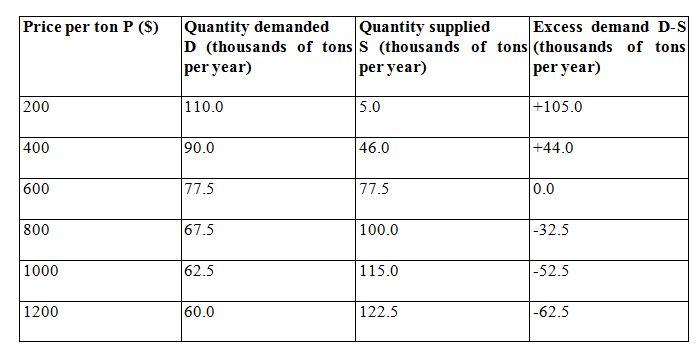

A market can he defined as any situation in which buyers and sellers can negotiate the exchange of goods or services. Table 2.5 shows the demand and supply schedules for beans. The quantities of beans demanded and supplied at each price can be compared.

Table 2.5 Determination of the equilibrium price of beans.

There is only one price of Ug. sh. 600 at which the quantity of beans

demanded equals the quantity supplied. At prices less than Ug. sh. 600, there is excess demand [a shortage) of beans because the quantity demanded exceeds the quantity supplied. At a given price, quantity demanded exceeds quantity supplied.

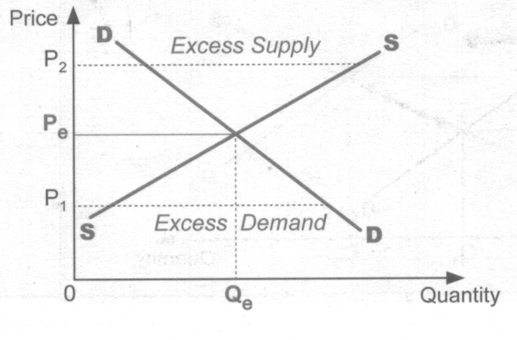

At prices greater than Ug. sh. 600, there is a negative excess demand (a surplus) of beans because the quantity supplied exceeds the quantity demanded. This is a situation of excess supply. This can also be shown graphically (Figure 2.17).

To examine the problem, let us assume a price of Ug. sh. 800. Al this

price, 100 kilogram of beans is offered for sale but only 67.5 kilograms is demanded. There is an excess supply of 32.5 kilograms. Sellers are then likely to cut their prices to get rid of this surplus. Similarly, the consumers observing the unsold stock of beans, will begin to offer lower prices. The excess supply leads to a downward pressure on the price.

This downward pressure is mainly due to the sellers offering a lower

price. Now lets assume a price lower than the equilibrium price say Ug. sh. 400. At this price, there is excess demand of 44 kilograms. Supply is only 46 while demand is 90 kilograms. Rivalry between consumers leads to offer a higher price than the prevailing price. Consumers tend to outbid each other in hope of securing the available commodity. Excess demand causes upward pressure on price. The upward pressure is mainly due to consumers.

At the price of Ug. sh. 600, producers wish to sell 77.5 kilograms and

consumers are willing to purchase the same amount of 77.5.

At this point, there is no tendency to change. We achieve an equilibrium price - the price at which quantity demanded is equal to quantity supplied. It is also called the market-clearing price. Any price at which the market does not clear (i.e. quantity demanded does not equal quantity supplied) is called a disequilibrium price.

Whenever, there is either excess demand (at a price less than OPe like OP-|) or excess supply (at a price higher than OPe like OP2) in a market, that market is said to be in a state of disequilibrium, and the market price will adjust until an equilibrium price OPe is attained.

Equilibrium price and quantity.